Is there an insurance company that covers older cars?

Is There an Insurance Company That Covers Older Cars? For many vehicle owners, finding insurance for older cars in South Africa can be challenging. The

Insurance.co.za – South African Insurance Quotes

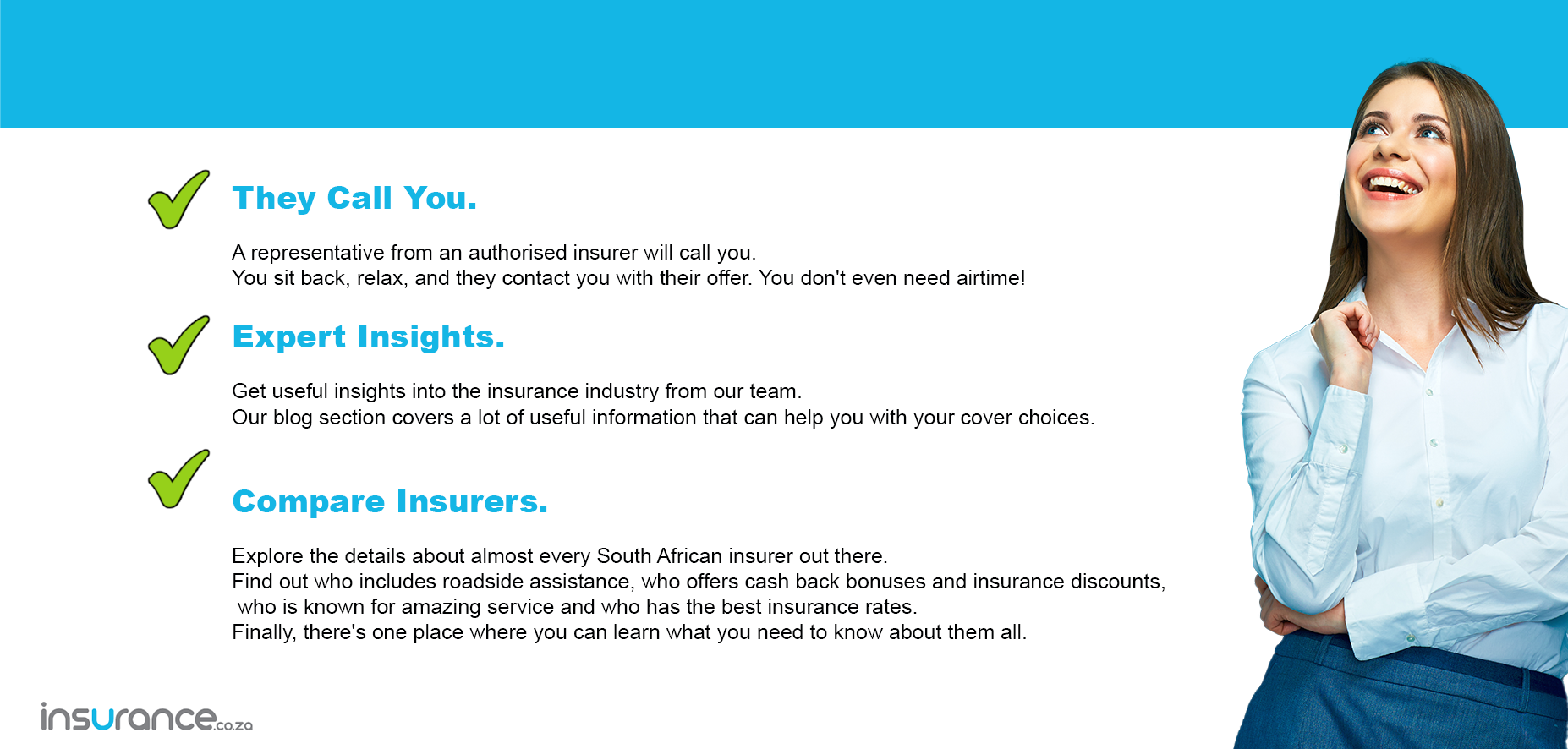

Looking for accurate quotes for financial protection at affordable prices? We get you free quotes for great insurance policies that suit your needs and budget from reputable South African insurance companies.

When you shop for insurance, it should be as easy as buying shoes. You simply compare your options and choose the ones you like. Our mission is to make your experience that easy.

We cut days of searching down to mere minutes. Take the stress and uncertainty out of comparing insurance and fill in our online form to get started. We do the sweating, and you get the rewards.

You may think one policy is as good as the next. But South Africa’s insurance market is very competitive. Your coverage options are many and diverse, and it can be hard to figure out what would give you the most back. That’s why our site can benefit you!

✓ Save on monthly premiums by finding the cheapest policy with everything you need.

✓ Find out if an insurance company is reliable for extra peace of mind.

✓ Make sure you choose the right type of policy for your needs.

✓ Save time with a hassle-free quote process.

✓ Discover different policy options on the market.

✓ Become more informed about insurance types and benefits.

Is There an Insurance Company That Covers Older Cars? For many vehicle owners, finding insurance for older cars in South Africa can be challenging. The

The Role of AI in More Tailored Insurance Solutions The insurance industry stands on the cusp of a monumental shift, with the specialized insurance market,

How to Protect Your Home Against the Increasing Risk of Break-In with Home Insurance In recent quarterly crime stats released by the South African Police